Off-market health plans are designed for individuals and families who do not qualify for meaningful ACA subsidies and are increasingly impacted by rising marketplace premiums. These plans are offered outside of the ACA exchange, allowing for more flexible plan design, broader PPO access, and lower monthly premiums for applicants whose health profiles align with underwriting guidelines.

What is a PPO?

A PPO, or Preferred Provider Organization, is a type of health plan network that allows members to see doctors and specialists without referrals and provides access to a broad national network of providers at negotiated rates. PPO networks offer flexibility and provider choice, which is why they are a key feature of many off-market health plans.

How Do Off-Market Plans Differ from ACA Coverage?

Because off-market plans are not subject to ACA exchange pricing and structure, they are able to offer more efficient benefit designs. This often results in lower premiums and wider PPO network access compared to unsubsidized ACA plans.

In exchange, these plans rely on medical underwriting and are not designed for individuals with heavy ongoing care needs, frequent specialty visits, or high-cost medications. The key difference is flexibility and cost efficiency versus guaranteed issue coverage.

What Plans Are Available Through EnrollPrime?

Through our partnership with EnrollPrime, O’Neill Marketing offers agents access to a curated lineup of off-market health plans designed to serve clients who are priced out of traditional ACA coverage.

Available options include:

AFI Cigna (Cigna PPO Network)

AFI Cigna is a true major medical option that is ERISA based and includes unlimited annual maximums with nationwide PPO access. It is well suited for clients seeking traditional insurance coverage without the higher pricing often associated with unsubsidized ACA plans.

MedMax (First Health PPO Network) and MedAccess (Cigna PPO Network)

These plans use a performance-style PPO design focused on predictable benefits and managed utilization. By structuring benefits more tightly, they offer lower premiums while still providing access to large national PPO networks at negotiated rates.

How Should Agents Position Off-Market Plans?

The positioning should always be around fit and tradeoffs. These solutions are designed to prioritize affordability, network access, and year-round enrollment availability.

They are not in the best interest of every client, and transparency is crucial. These plans are not intended for individuals with significant ongoing medical needs or reliance on high-cost specialty medications. Medical underwriting is in place to maintain long-term pricing stability and plan sustainability, not to limit access to care once coverage is active.

Setting clear expectations leads to better understanding and stronger client satisfaction.

Which Clients Are the Best Fit for Off-Market Coverage?

Off-market plans are best suited for healthier individuals and families who are seeking relief from marketplace premium inflation, broader provider choice, and coverage that aligns with realistic healthcare usage.

For these clients, off-market coverage can deliver meaningful savings while still providing access to quality care.

How Do Off-Market Products Compare Side by Side?

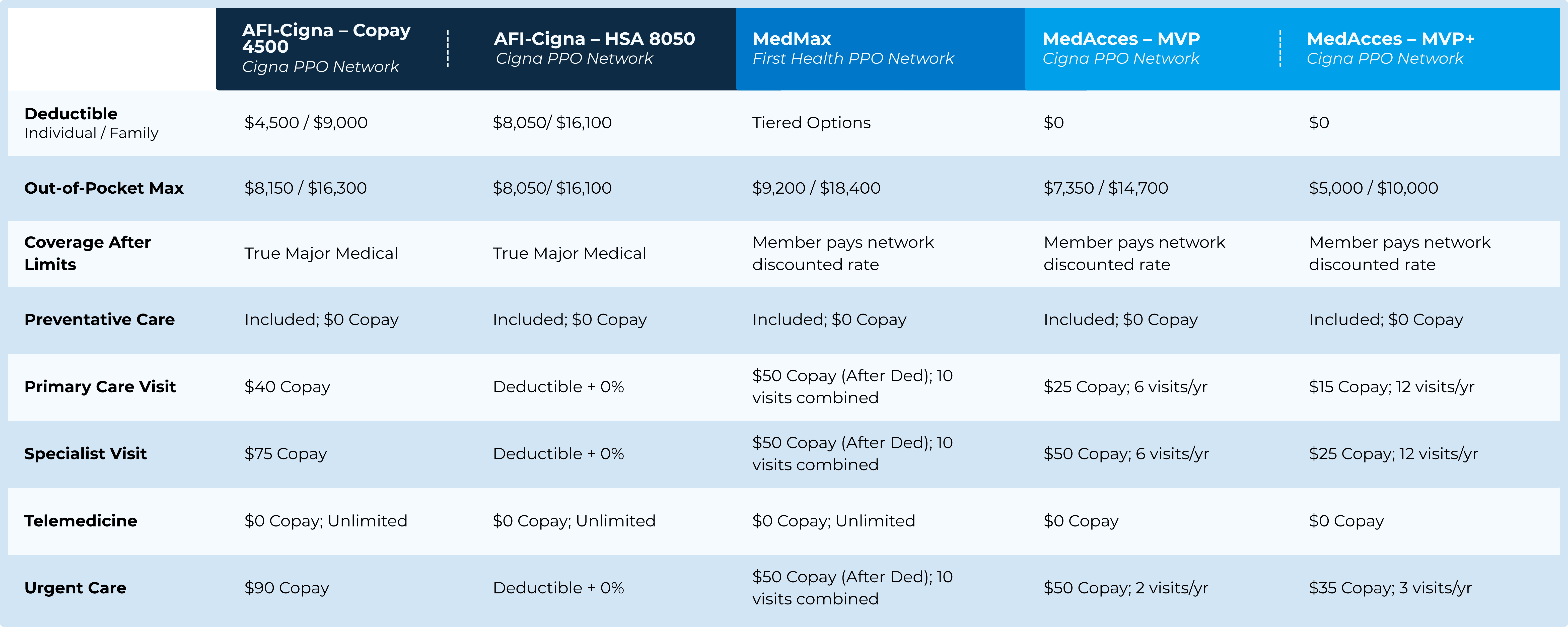

Not all off-market plans are built the same way, and understanding the differences is the key to matching clients with the right solution for their needs. Each product differs by plan structure, network access, benefit design, and ideal use. The comparison below highlights the core differences between the products available through EnrollPrime, making it easier to evaluate how each plan is designed and what client each best serves.

They are not intended to replace ACA coverage for every consumer but offer a strong alternative for healthier clients who are paying full or near-full marketplace premiums and are looking for more cost-effective options.

Off-market health plans are not one-size-fits-all solutions, but for the right client, they can provide flexibility, savings, and relief from rising ACA premiums. When you lead with education, transparency, and proper positioning, these plans become a powerful addition to the coverage conversation.

Take the next step.

If you’re working with clients priced out of ACA coverage, off-market plans may offer a better fit. Access EnrollPrime through O’Neill Marketing to review plan details, underwriting guidelines, and comparison tools designed to help you match the right solution to the right client.

Reach out today to get started!